By Scot Campbell, Broker | Source: Realtor MLS, FreddieMac, NAR

By Scot Campbell, Broker | Source: Realtor MLS, FreddieMac, NAR

Revised – December 28, 2023

How is the Huntington Beach Market?

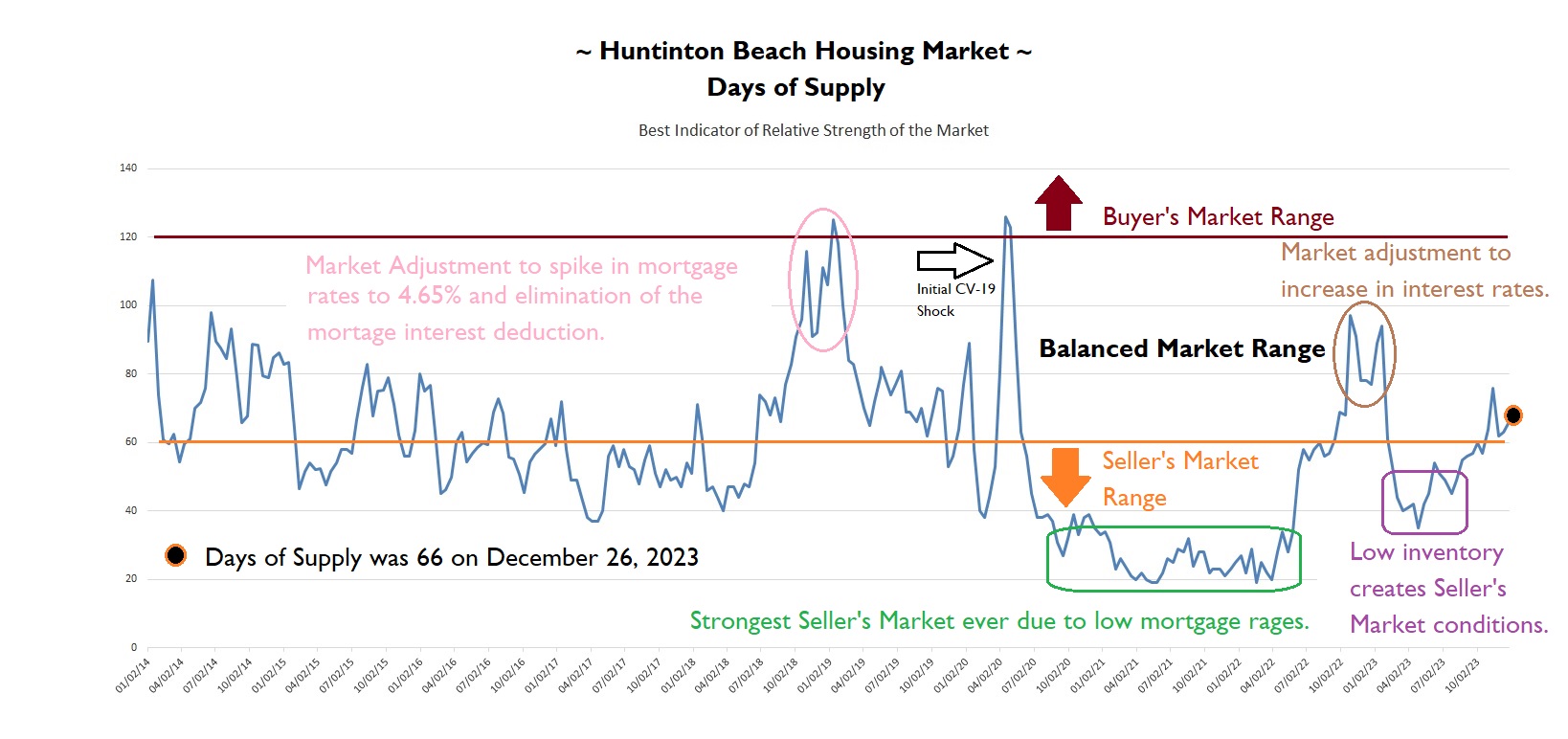

“Days of Supply” is the best overall indicator of real estate market conditions in Huntington Beach. I have been tracking the numbers carefully since 2014.

A Days of Supply reading above 120 is a Strong Buyer’s Market, and Days of Supply below 60 is a Strong Seller’s Market.

The Days of Supply was 66 on December 26, 2023.

So, presently, we are experiencing conditions of a slight Seller’s Market as we move into the final week of the year.

What should buyers & sellers expect as we move into 2024?

- Buyers will find that homes which are priced close to market value and in good general condition will sell quickly… and they will be disappointed that there are not more homes available to purchase. However, they will be pleased at the buying conditions in comparison to the 2021 CV-19 market (when Days of Supply was hovering around 20 and there were multiple offers on everything)!

- Home Sellers will find a strong level of activity for their home and will get top dollar if: 1) They prepare the home for the market 2) Hire a Realtor who does an excellent job marketing the home with beautiful imagery 3) Price the home “close” to market value.

Normally early January is a slower time of the year to buy or sell; however, with mortgage rates falling by 1.25 percent in the last 10 weeks, now is a very good time to put a home on the market or purchase a home.

What happened with Home Sales Volume?

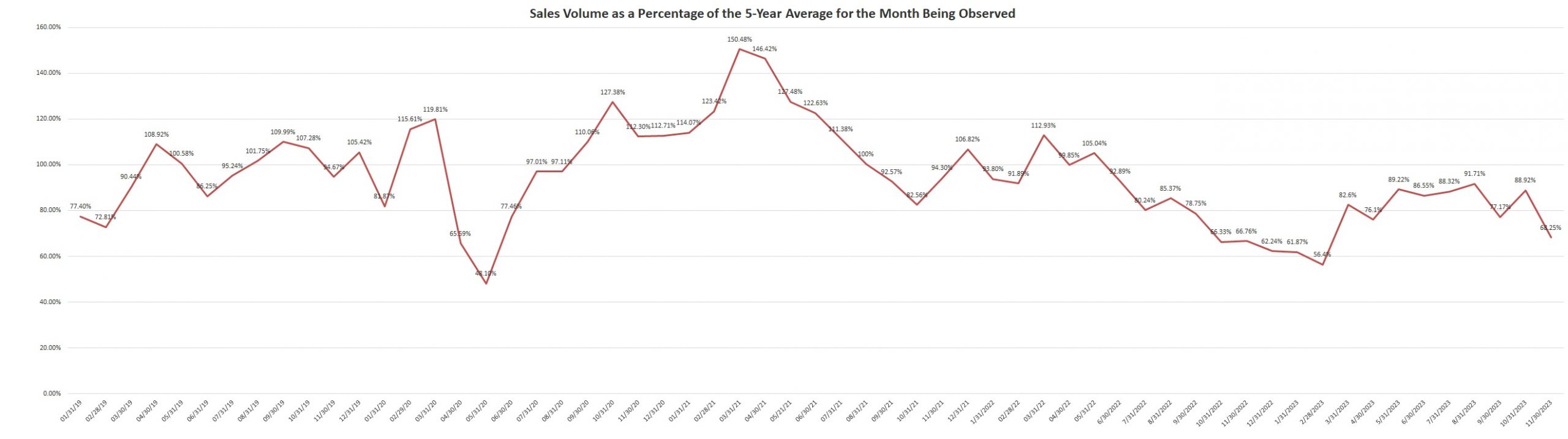

I have been tracking the numbers carefully since 2014. Certainly, there has been significant variation in the sales volume due to the pandemic and then subsequent spike in mortgage rates. Looking at Sales Volume as a percentage of the 5-Year Average for the month being observed is a better way to see where sales volume is today as compared to “Normal”.

In 2023, Huntington Beach saw a significant drop in the number of homes sold due primarily to high mortgage rates.

The sale volume was 112% of the 5-Year Average in March 2022 (just before mortgage rates began increasing).

- Mortgage rates continued rising for most of 2022 peaking in November at 7.08%. By February 2023, the sales volume dropped to just 56% of the 5-Year Average.

- Spring is typically the beginning of the selling season and a drop in mortgage rates (which bottomed in on February 2, 2023 at just 6.09%) reignited the market with sales volume jumping upto 82% in March… and ranged between 76% and 91% of the 5-Year Average during the Spring to Summer selling season.

- By October, mortgage rates spiked again to just below 8%. The result was another drop in Sales Volume to just 68% of the 5-Year Average for November 2023.

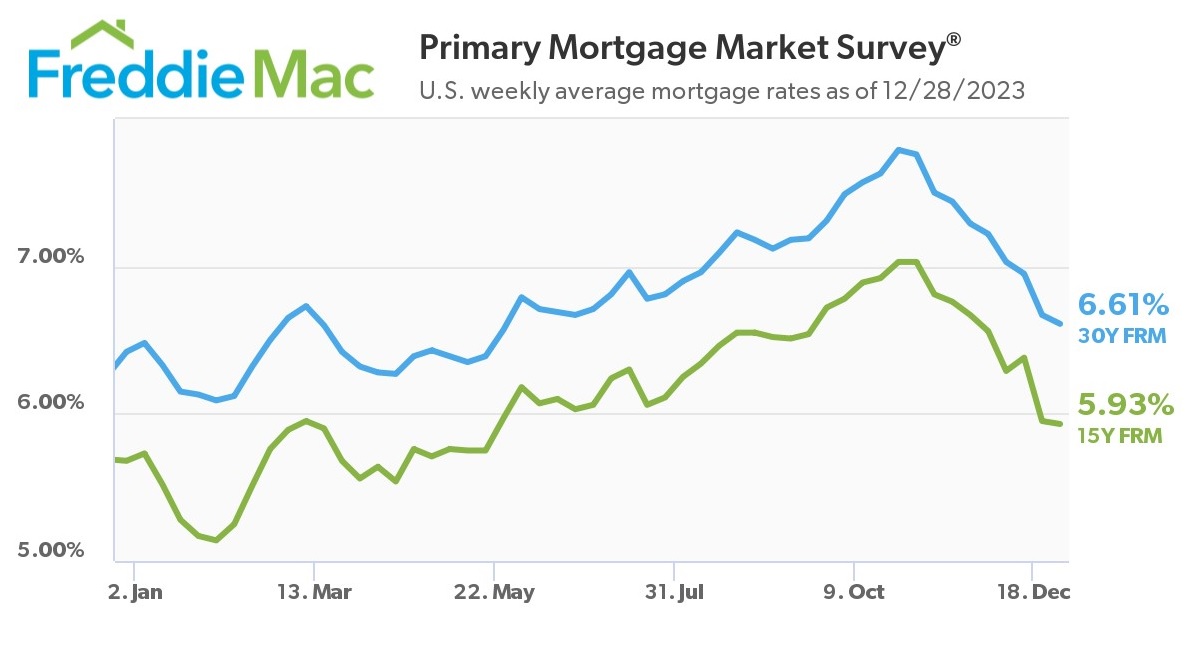

From October 2023 to December 28, 2023, mortgage rates fell about 1.25 percent (125 basis points) to just 6.61% according to FreddieMac.

It is likely that the Sales Volume for late December 2023 rebounded, and we will see further improvement in buyer activity as we move into the New Year.

What happened with Home Price Appreciation?

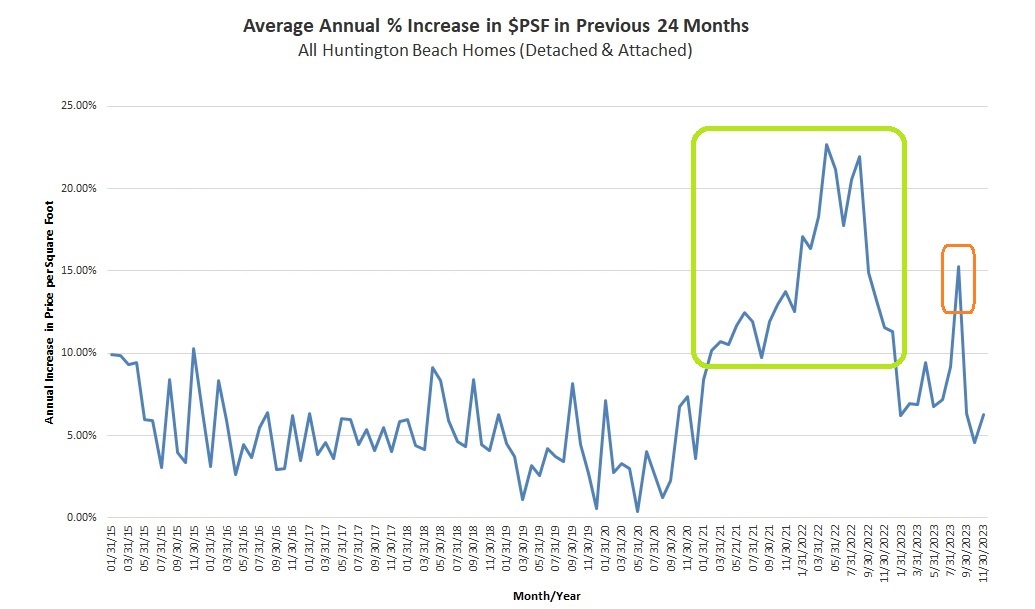

I have been tracking the numbers carefully in my spreadsheet since 2014. I have found, over the years, that Average Annual Home Price Appreciation in Huntington Beach hovered around 5% in the years 2015 through 2018.

- In 2019, price appreciation was in the 3% range due to a combination of mortgage rates spiking up 1% and the elimination of the mortgage interest deduction (tax savings for owning a home reduced/eliminated).

- The CV-19 Market (with historically low mortgage rates below 3%) lasted from late 2020 until Spring 2022, and this period saw double digit price appreciation which averaged over 15%.

- When interest rates more than doubled in Spring 2022 into the high 7% range, price appreciation slowed dramatically falling back into single digits again.

- In 2023, Average Annual Home Price Appreciation has fallen back into single digits and appears to be in the 6.5% range for the year.

In 2024, Average Annual Home Price Appreciation should be supported by the recent fall in mortgage rates. There does not appear to be any crash in home prices as many buyers had hoped to see.

The CV-19 Market saw sustained double-digit appreciation from late 2020 until Spring 2022.

August 2023 was an anomaly with 9 homes selling between $3.25 and $7.4 million and price-per-square foot ranging from $1,076 to $1,785. This has never happened in one month before or since.

What is happening with Mortgage Rates as we move into 2024?

According to the FreddieMac Primary Mortgage Market Survey, on December 28, 2023, 30 year fixed rate mortgage rates have fallen to just 6.61%.

Heading into the New Year, Mortgage Rates Remain on a Downward Trend – The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down. Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.

Many Home Buyers have been on the sidelines for months waiting for mortgage rates to decline.

January 2024 is going to be a great time to list a Huntington Beach home since there is certainly going to be a shortage of inventory relative to the number of buyers looking to purchase.

Where is the market headed in 2024?

I have been tracking the numbers carefully in my spreadsheet since 2014, and carefully observing what moves the market. With the exception of the elimination of the mortgage interest deduction, the strength of the real estate market is most highly correlated with the availability of mortgages and the level of mortgage rates.

Mortgage rates have already fallen over 1.25 percent (125 basis points) since their peak in October 2023, and general predictions from experts are that rates will fall further in 2024. Inventory will remain very low since most homeowners have a very attractive mortgage with a rate below 4%… they simply have no incentive to sell.

I predict 2024 will be a better time to sell (thanks to low inventory & enhanced buying power brought on by lower mortgage rates). Buyers will have more competition in 2024, but will certainly welcome the lower payments from plunging mortgage rates

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link