What did Southern California homeowners “who needed to move” do the last time there was a housing market slowdown coupled with high mortgage rates?

By Scot D. Campbell, Broker | Coldwell Banker-Campbell Realtors | Southern California

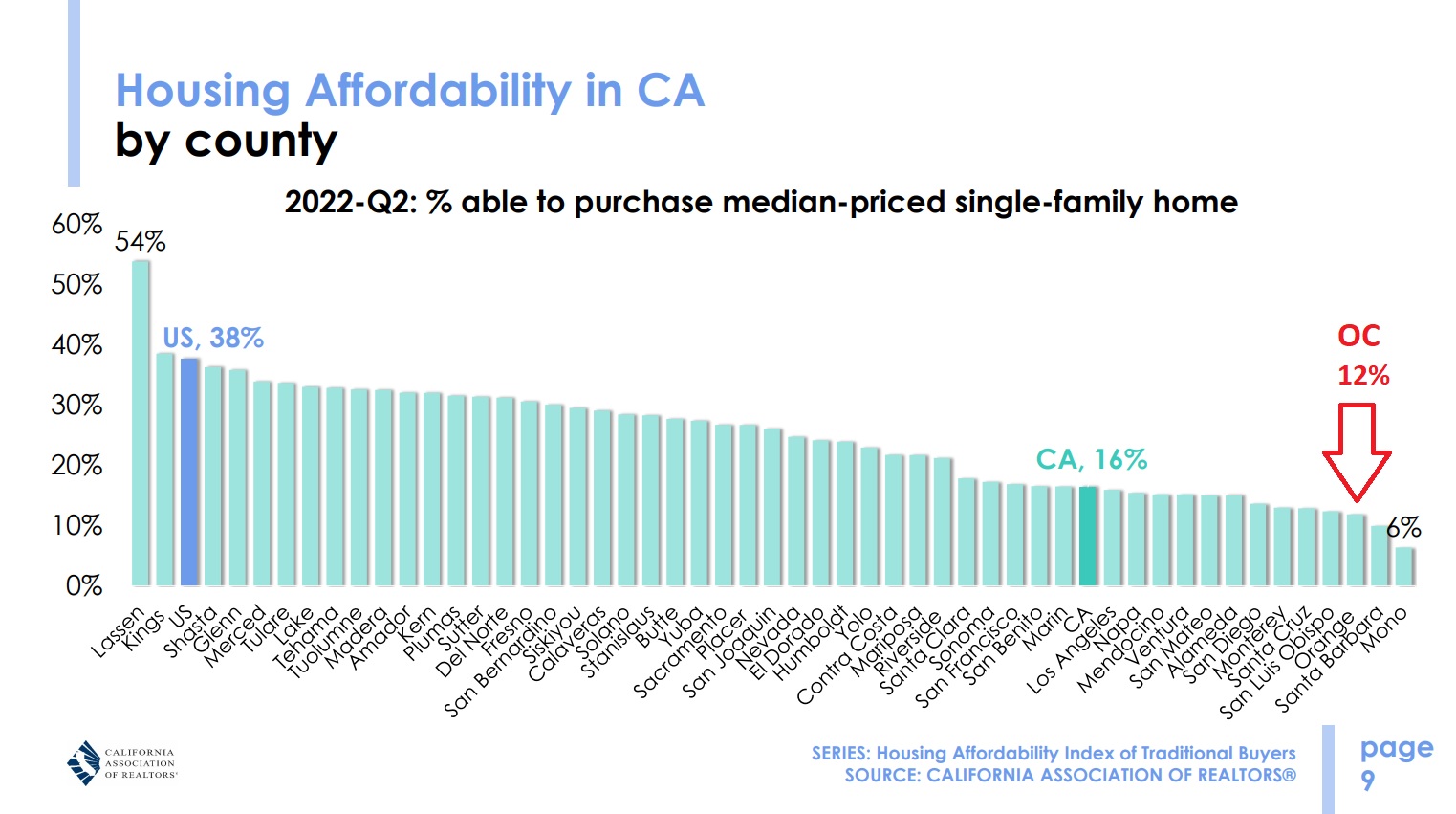

CAR Housing Affordability Index 2022Q2

Background: It was June 1990… I had been working in Property Management while in college, and just graduated from CSUF with a degree in real estate finance. It was time for me to start working full time in the real estate industry. After a real estate market peak in late 1989, the Southern California market headed into a deep slump that did not end until 1995. Why? We had a regional economic recession related to defense cuts (about 300,000-500,000 high paying jobs lost between 1986 and 1993 according to the LA Times). While the economy in other parts of the country was on a positive growth path, Southern California employment was struggling.

There were home owners who needed to sell their homes to accept employment elsewhere and others who needed to sell for various other reasons. The average mortgage rate was 10.13%.

Many home owners decided to hire knowledgeable real estate agents (like me) to get the job done using ethical and responsible Traditional and Creative Techniques which allowed home owners accomplish their housing goals.

There is nothing more traditional than “Just renting it” when a homeowner wants to move elsewhere during a “slow market”. Here are some considerations and important future dates to remember:

Lease the Home: One of the fantastic investment aspects of owning property is that it can be “leased out” for income if a homeowner decides they need to move to a more suitable home. The most important aspect of leasing is finding a tenant who will pay the rent on-time and look after the home. This is especially true today when evicting a non-paying tenant is more difficult than ever before, and since our national economy is intentionally being slowed down by the Federal Reserve. Another consideration is section 121 of the IRS code which allows homeowners to exempt $250,000 per spouse from capital gains taxes provided the home was your principal primary residence 3 out of the last 5 years. If the lease term goes beyond 3 years, you no longer qualify for IRS Section 121. Any homeowner who wants to get the equity out of the property within a few years, has a significant capital gain, and wants to reduce or eliminate taxes on their gain should terminate the lease and target a sale/closing of the property within about 2.5 years of moving out of a principal residence (it is risky to go right upto the 3 year deadline). Leasing Service is something I have been offering my clients ever since I entered the business working for my father who was a “Certified Property Manager.

Sometimes homeowners have no interest in becoming a traditional landlord, so “renting it out” is not the answer.

That is when Creative Marketing can come into play during a market slow down. Creative techniques center around offering convenience or terms which allows a buyer to purchase a property when they otherwise would not.

In the next few pages, I will outline the techniques that I observed in the early 1990s… the last time we saw a peak in home prices in Southern California followed by a slowing market with high mortgage rates.

Let’s talk about two very traditional conveniences that a home seller can offer to a buyer to increase the probability of a sale during a slower market:

Allow a Contingency for sale of buyer’s property: During the seller’s market we experienced in 2021, the only offers considered were All Cash and offers not contingent on the sale of the buyer’s home. However, there are many potential buyers who must sell their home first in order to buy. These buyers had zero chance of buying a home in 2021… there were multiple cash/non-contingent offers on every home. If you allow buyers the convenience of putting their home on the market and selling it after they have found your home, there will be more potential buyers for your property. As a realtor, I am very careful to do research on the buyer’s home to make sure it is likely to sell, and I limit the length of a continency period and extensions are only considered after a careful market review of the buyer’s home and their activity. I may structure the agreement as a “first right of refusal” in case another offer arrives which is worth considering.

Trade: If a buyer for your home already has their old home in escrow, perhaps that buyer would be keen to purchase your home. But, sometimes in a slow market, buyers do not want to put their property on the market because they think it will not sell or the process would be difficult due to occupants, tenants, etc. Thus, they will not make an offer on your home even though they would love to own a home like yours. What if you are a “great buyer” for the property they need to sell in order to buy your home? It happens, and we call these “Trade Transactions”. Sometimes the buyer’s property offers the opportunity to down size or is suitable as a second home/rental. Over the years I have been involved in Trade Transactions and I know how to structure these “convenience” sales.

When the real estate markets slow down, creative techniques may also center around offering terms which allow a buyer to purchase when they otherwise would not.

There are many cases where the home seller would really benefit by offering creative terms. The key is to offer security to the seller and opportunity to the buyer.

Installment Sale: With a sizeable down payment (and/or additional security via a blanket encumbrance) a home seller may elect to carry the financing on a home they are selling. This technique is ideal for sellers who own their property free & clear (or small enough mortgage balance to pay off with the buyer’s down payment). Often sellers accept “interest only” installment payments when there is substantial capital gains on the home (exceeding the $250,000 per spouse exemption)… this allows the seller to collect interest on money which would have already been paid to the IRS in capital gains taxes. The interest collected by the seller on an installment sale can be very substantial as compared to putting the proceeds of a standard sale (after taxes) into a bank account. And, given recent gyrations in the stock market, many sellers might welcome a reliable return on their money. I can project an annual rate of return if you would like to see some numbers. Good things do not last forever… Eventually, when the loan is paid off, the capital gains taxes are due.

Lease Option: Homeowners who have a very low mortgage rate and assessed tax value have a very sweet deal going. For a variety of reasons (moving out of area, do not want the hassle, maintenance concerns, possible eviction) many homeowners are reluctant to become landlords. There are cases when those homeowners have very high tax capital gains tax burdens if they sell their home. If you rent the home out for a couple years (converting it to an investment property), then do a 1031 exchange (into an investment property) the capital gains taxes can be deferred. When a lease-option is structured correctly (big upfront option money, extendable term, reasonable strike price), the tenant/optionee treats the property like they own it, and at the end of the option period is nearly certain to exercise the option (take title to the home). There are so many ways to structure a Lease Option in terms of the Option Money, Term, Strike Price, Extensions… and, I can answer your questions.

Yes, there are lots of alternatives to the “standard home sale” when the market slows down.

Rent it out, Contingent Offers, Trade Transactions, Installment Sales, & Lease Options all come to mind as alternatives.

Offering the convenience of a contingency to a buyer does not cost anything, or you may be a “great buyer” for a property owned by your buyer.

Would you benefit from the tax benefits & income offered by an Installment Sale? Is your tax situation something that indicates you would be wise to lease (or lease/option) your home even if you are a reluctant landlord?

Should you do a 1031 exchange into a rental? Or, should you lease it then sell it before the 3 year IRS section 121 deadline?

Which one is best for you in today’s market if your home does not sell as a standard sale? There is certainly a lot to consider.

Fortun ately, I know the answer… but I will not be able to give you the best alternatives until I have listened carefully to your goals and situation. I am happy to meet with you in person to discuss your situation and explain the benefits of these standard sale alternatives.

ately, I know the answer… but I will not be able to give you the best alternatives until I have listened carefully to your goals and situation. I am happy to meet with you in person to discuss your situation and explain the benefits of these standard sale alternatives.

Even if you elect to do a Standard Sale in the end, you will have the peace-of-mind that you checked out all of your options.

Contact me direct by cell phone: 714-336-0394 or via email: Scot@CampbellRealtors.com.

Note: There can be significant negative tax & financial consequences when transactions are not structured properly. Do not attempt to do any of these alternatives without the help of an experienced realtor, attorney, and tax planner who know the applicable laws, best practices, and forms necessary to complete the transaction.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link